Liquid Exchange Rating

-

Overall Score - 91%91%

Summary

Liquid is a recommended exchange for cryptocurrency trading, the exchange offers all of its clients an intuitive trading platform with good customer service. You can sign up in the link below or continue reading the full Liquid review to learn more about Liquid.

Liquid Review

For our next review article of a cryptocurrency brokerage firm, we would be looking at one of the most successful and oldest trade platforms that have stood the test of time – that is, Liquid Exchange.

Perhaps due to the simple funding model of ICOs, the advent of cryptocurrency saw the emergence of an ever-increasing number of blockchain startups. That blossomed as advocates of the technology came together to pursue very ambitious ideas. Some of these ideas resonated with its proponents -while some other people, it turned out, were just driven by the hype.

Fast forward to today, a lot of these projects have closed shop. Of all the kinds of projects ever launched via blockchain technology, exchange platforms have probably had the highest success rates, at least going by their longevity.

And that has occurred even though these exchanges don’t receive the same regulatory backing and the social acceptance enjoyed by their counterparts in traditional money markets such as Forex, stocks, etc.

Whereas traditional brokerage sites don’t get scrutinized for user interfaces that are sometimes out-of-fashion or go through a relatively complex process of integrating several asset classes, crypto-based platforms must ensure that end-users have an intuitive interface with which to interact. They must also avail a sophisticated facility that makes it simple for several tokens to run efficiently without any form of glitch.

Then there is the lingering problem of a regulatory framework to support blockchain projects, not to say much on the possibilities of crypto-friendly policies in the interim as the circle of global powers continue to turn their back to the ecosystem.

All these and more are the reasons why the evolution of exchange platforms is rife with challenges. That is why the few ones who can maintain operation for prolonged periods, even up to this moment, must be doing at least certain things right.

That and more informs the background of this particular review. How has Liquid exchange sustained its operation in the fast-moving world of blockchain technology? What are the things it has done better in its seven years of existence – where several similar initiatives had gotten buried in the dust?

Let’s find out!

Introducing Liquid Exchange

The exchange was established in 2018 after the Fintech giant, Quoine, then making its way into cryptocurrencies, merged two of its already operating crypto services outlets- Qrypto and Quoinex, thus birthing the name “Liquid Global”. The said merger occurred in 2018, but both subsidiaries were founded in 2014.

Liquid is currently operated from Singapore and is reported to be in pursuit of a regulatory license. This license is the Digital Payment Token from the offices of the Monetary Authority of Singapore.

If this pursuit is successful, Liquid would be required to fully adhere to the obligations stated in the Payment Services Acts of the Commission.

Nonetheless, Liquid has its origins in Japan, where it had been awarded a still operational license under the jurisdiction of the Japan Financial Services Agency. That made it the first of such projects certified by the agency.

To date, there have been no accusations of misconduct or legal trespassing filed against the platform- thus signaling a good hint that the team indeed takes compliance issues very seriously. It was even well-publicized when in July 2017, the team delisted about 30 crypto assets as regulatory concerns about them arose. Overall, Coinmarketcap gives it a score rating of 7.3.

Liquid Global achievements after two years of the merger

As recent as March this year, Liquid ranked 10th on a list of the 10 top crypto exchanges, published by popular tech blog: Fintech Magazine. That a few other top exchanges such Coinbase and Kraken featured on this list makes Liquid’s position an achievement worthy of note.

According to the magazine, Liquid has recorded an estimated $81 billion year-to-date trade volume. That, however, may be expected considering the $50 billion volume disclosure in 2019 accumulated within 12 months on the exchange. But for comparison’s sake, Coinbase recorded about $150 within the same time-space.

But that is not all. Within a few years, after the platform opened its doors to customers, the team amassed a good reputation both from the general public and critics.

In October 2017, Liquid made history as the first blockchain project to have successfully held an ICO (initial coin offering) in Japan across borders, then tagged Qash Token Sale.

At the end of the token offerings, over 350,000 ethers were raised in what turned out to be massive participation, as the 350 million Qash offered were oversubscribed. Nonetheless, it is worth noting that this was at the height of the then “crypto projects gold rush.”.

In October 2018, after the merger got confirmed in September of the same year, Liquid was mentioned as one of the most innovative companies on KPMG’s list of the top 100 Fintech ideas. In April of the following year, Liquid joined the list of globally recognized tech unicorns after the first round of a fundraising event, which catapulted the total market worth of the exchange to over $1 billion.

May that year (2019), Liquid announced the launch of “Liquid Pro” software, adopted to enable easy and efficient access on mobile devices.

In the future, Liquid plans to create an independent blockchain-enabled distributed ledger- much like Ethereum’s- to empower other fintech in building products and services that might require such frameworks.

Review on users’ trading experience with Liquid exchange

- The Liquidity

It is essential that you critically consider the liquidity of the exchange platform whose gateway you are using.

That is especially true if you are the type to avoid sudden deflation in value, or you want to be able to move in or out of your investment in any asset.

Now, liquidity is a measure of the ease at which a trade position can be entered and the speed at which an order is executed. What’s more, an exchange with tight liquidity will not only mar your trading experience but can unleash some devastating effects on your funds.

That said, Liquid has not performed well in that aspect. However, as of December 2018, Coinmarketcap placed it among the top 20 most liquid exchanges, as its trade volume of 30-days exceeded $4 billion. Fast forward to today, it is ranked 15th with a 24-hour trade volume of about $192 million accumulated from 164 actively traded markets.

- Liquid Exchange Order Book

Even advanced traders admit that most exchanges nowadays feature needlessly complicated interfaces, which can be overwhelming for beginner traders. Perhaps, for that reason, Liquid exchange takes a unique approach by using the proprietary concept of a “World Book.”.

In essence, the exchange uses the technology to process universal order books where trades are processed through automatically sourced liquidity pools. Also, Liquid exchange integrates a simplified version of TradingView’s charts – by displaying fewer toolbars from what otherwise resembles an intimidating menu.

- Fee charges on Liquid

Liquid exchange uses a different fee model for every kind of transaction- whether deposits, withdrawals, on-site trading, or futures contract participations.

- Trading fees on Liquid

To understand how trading fees work on this exchange, you need to get around the two basic concepts of “maker” and “taker”. The former refers to the category of traders who create a position on the order book in the first part of a trade, while the latter refers to those who create matching orders for the already existing positions. Thus, both parties are present in every successful trade.

Liquid uses a 0.3% fee for taker (buy type) transactions, though the rate decreases directly with trade volume. For small pocket traders with monthly traded volumes not exceeding $10,000, the fee drops down to 0%.

As regards the maker fee (sell type), the fee rate is capped at 0.3%. But it also reduces in line with the volume involved. Perhaps the reason behind the rapid decrease in maker fees is to maintain good liquidity on the exchange.

However, users can trade at half the usual fee by fueling all transactions with Qaah tokens. Generally, the average value in trading fees for the entire industry stands at 0.25%.

Lastly, it’s worth noting that Liquid runs a perpetual reward scheme where users’ trading fees increasingly depreciate if they can transact up to a pegged volume.

- Withdrawal fees on Liquid exchange

The standard withdrawal fee charged across most trading platforms is reported to be around 0.0006 BTCs. When you compare that with Liquid’s fees for such a transaction, currently set at 0.0007 BTCs (fixed), the difference is not much.

For Ethereum, 0.01 ETHs are deducted from all withdrawals. While the figures for withdrawals might appear huge if denominated to fiat currencies ($18 for the Ethereum Network and $41 for Bitcoins), it is worth noting that they are not collected as commission, but cover the miners’ fees.

For fiat-based withdrawals, the minimum charge starts from $15, or generally, 0.1%. of the transaction value (but not below the $15 mark).

- Deposit fees on Liquid

There is a zero-fee charge for deposits of digital assets. However, for fiat currencies, the resultant deposit fee depends on the payment channels used. But at least on its end, Liquid deducts nothing from users’ deposits.

- Futures contract trading fee

Generally, only takers have the privilege of enjoying the discounted fee offer when using Qash tokens to pay for transactions. If a taker chooses to pay for a transaction using other options, the total standard fee of 0.12% will be applied.

Makers trade free-of-charge and could even see that value drop to a negative if they traded sizable amounts.

Forms of trades on Liquid exchange

On top of the sleek user interface, Liquid provides different asset classes for its customers. Thus, if an investor wishes to diversify his portfolio across a broad range of assets, this exchange is a one-stop-shop for that.

Specifically, users can trade via the Spot, CFDs, futures, and margin trading dashboards. We go in-depth on each of them below:

- Margin trading on Liquid

Under this category, users can trade toggling between different pairs of crypto-to-fiat, leveraged up to 25 times.

On the other hand, non-expert traders can plug into the lending services to make their funds available to the experienced hands, while raking in substantial profits.

- CFDs contracts Liquid

This feature, which is also styled as “Liquid Infinity,” offers users access to a speculation market for several assets. That means, rather than betting into the volatility of an asset’s price by buying or selling it – a user only needs to collateralize his “forecast” of the price, then hope the markets move according to the expectations.

Investors in these markets can access leverage offers of up to 100x if they trade with the BTC-USD or BTC-JPY pairings.

- Futures contract trading

That is one of the newest futures on Liquid’s trader’s dashboard. However, it is only available for the BTC/USD market- the reason being that most futures traders migrating into the crypto world do so with the prospect of benefiting from the fast-rising Bitcoin’s price.

Liquid calls this product “P-BTC”. It differs from other perpetual Bitcoin futures contracts; prices are evaluated in terms of Bitcoin’s worth rather than the USD. Liquid uses a variable 1:100 leverage offer for P-BTC trading.

Currencies available on Liquid exchange

Hitherto, crypto users have been troubled with one big issue- the complex addresses of blockchain wallets. While some find that feature appealing as it feels extra safe since the character string is hard to decipher – it has caused a number of problems for some.

When one single letter or number is misrepresented, a user might end up sending funds to a “mysterious” user. That is why, starting January 2021, Liquid enabled the use of FIO addresses for deposits, which very much resembles an email address!

With that said, let’s now review the two classes of available currencies on this exchange:

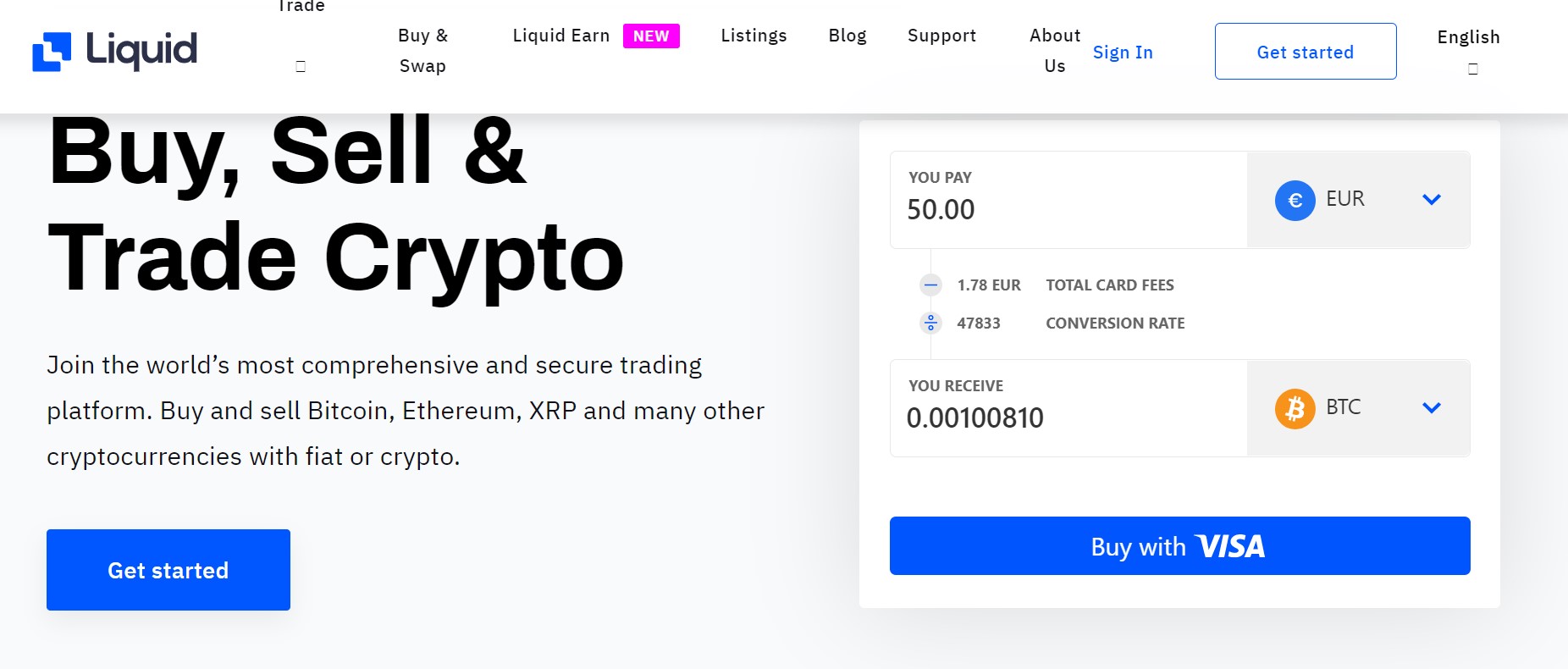

- Fiat currencies: according to Liquid, it has “local partners” in counties such as the USA, Japan, Singapore, and Vietnam, staffed with professionals from the financial sectors. With their help, they can process fiat transactions in USD, JPY, AUD, HKD, SGD, and EUR. Users can deposit any of these currencies using their debit cards or through international bank wires. Visa credit cards are also supported.

In addition to these options, Europeans can use the payment processing gateway, SEPA, to deposit. To date, Liquid remains one of the largest exchange sites with the highest volume of fiat-based and fiat-paired transactions.

- Cryptocurrencies: Liquid provides over 100+ crypto tokens that users can deposit and withdraw at any time. Interestingly, there is a feature that enables prompt buying of crypto through electronic cards, but doing so will attract a predetermined fee.

KYC requirement on Liquid

Of the few issues users have reported while using this exchange, this one seems to be most frequent. Liquid requires users to submit necessary verification documents to be able to make unlimited withdrawals.

However, some users only get to learn about this after depositing their funds. To further worsen the grievances felt, most complain of how it ends up taking too long before the identification documents are confirmed and verified (or otherwise).

However, it is expected that resolutions are already underway to fix it. Before then, you should get familiar with the following transactional limits:

- Users with unverified accounts can only withdraw up to a maximum of $2000 daily and $20,000 annually.

- Users with verified accounts can withdraw up to a maximum of $30,000 on a daily basis and $300,000 in a month.

- Instant crypto purchases via Visa credit cards are capped at $2000. The limit might be increased soon.

- Lastly, if a user wishes to withdraw directly into a bank account, KYC verifications must first be confirmed OK, irrespective of the amount involved.

Liquid and the US crypto market

Liquid generally prohibits client registration from the US. However, a US citizen might be able to trade between the crypto-to-crypto pairs.

The reason is that the Security Exchange Commission (SEC) of the US imposes stringent restrictions on crypto exchanges, thus preventing them from operating in the state. It mandates excessively burdensome requirements to permit such ventures to run in the country.

Other unsupported countries

You might also be restricted to crypto-only markets on Liquid exchange if you are from any of these countries:

Libya, Albania, Barbados, Cambodia, Botswana, DPRK, Cuba, Ghana, Jamaica, South Sudan, Iceland, Panama, Iran, Mauritius, Myanmar, Sudan, Mongolia, Zimbabwe, Guam, Yemen, Puerto Rico, Pakistan, Virgin Islands, Northern Mariana Islands, American Samoa, Iran, and Somalia.

Customer support services on Liquid exchange

The customer service unit typically responds quickly, and you can contact them through the email address provided on the site.

Alternatively, there is an easily-accessible “Help” section where you will find answers to frequently asked questions (FAQs) and essential articles explaining some of the features available on-offer.

Aside from the prolonged turn-around time for KYC verifications, there are hardly any complaints from users regarding the quality of the Liquid customer support team.

Conclusion

With an operating license from a crypto-conservative institution like the Japan FSA and a track record of running as a law-abiding business, we consider Liquid to be a trustworthy exchange platform.

Users only need to ensure they protect their sign-on details, preferably using the 2FA method. Then, traders must be careful when using the leverage sizes as there are critical risks involved.