This was based on data collected from the analytics platform Santiment. There were more than 135,000 registered Ethereum addresses. Over 11% larger than the highest number in January 2022. The most registered Ethereum addresses were last at their maximum number in January 2022.

📈 #Ethereum saw a surge of new addresses created Saturday, with 135,780 new $ETH addresses popping up on the network. This is 11.1% more network growth than the next highest of 2022 (Jan 3rd). Utility rises commonly foreshadow potential asset breakouts. https://t.co/tIRv6sJxJc pic.twitter.com/boA6v5jk8W

— Santiment (@santimentfeed) October 9, 2022

Investigating The Roots of The Increase

The rapid rise of registered Ethereum addresses couldn’t be attributed to a single factor. On the other hand, some theories investigated for possible reasons were present. Because Ethereum’s Proof of Stake (PoS) network is the most widely used smart contract, it has attracted dApps.

The Ethereum Virtual Machine is compatible with several blockchain projects (EVM). DApps from other chains may connect to Ethereum if EVM compatibility is enabled.

This could be because users need new Ethereum addresses to access and participate in these initiatives. Investors in Ethereum who were hesitant due to PoW’s power consumption may have been encouraged by PoS. This is because PoW forces miners to put in the labor to verify transactions.

Network Size Has Increased, Yet TVL Has Decreased

Santiment’s network growth data up to October revealed a mostly flat trend with little upticks. On the other hand, the growth rate was quickly increasing and reached 208,000. Additionally, it was shown that there were 2.5 million active addresses throughout the week. This measure was growing, albeit not to its maximum.

According to Messari, the Ethereum network is the most valuable innovative contract platform, costing $161 billion. Messari revealed that the Total Value Locked (TVL) exceeded $31 billion.

In November 2021, TVL for the network reached an all-time high of $109,94. On the other side, the TVL had dropped by 0.15% since this piece was published.

Is There Any Chance of An ETH Price Increase?

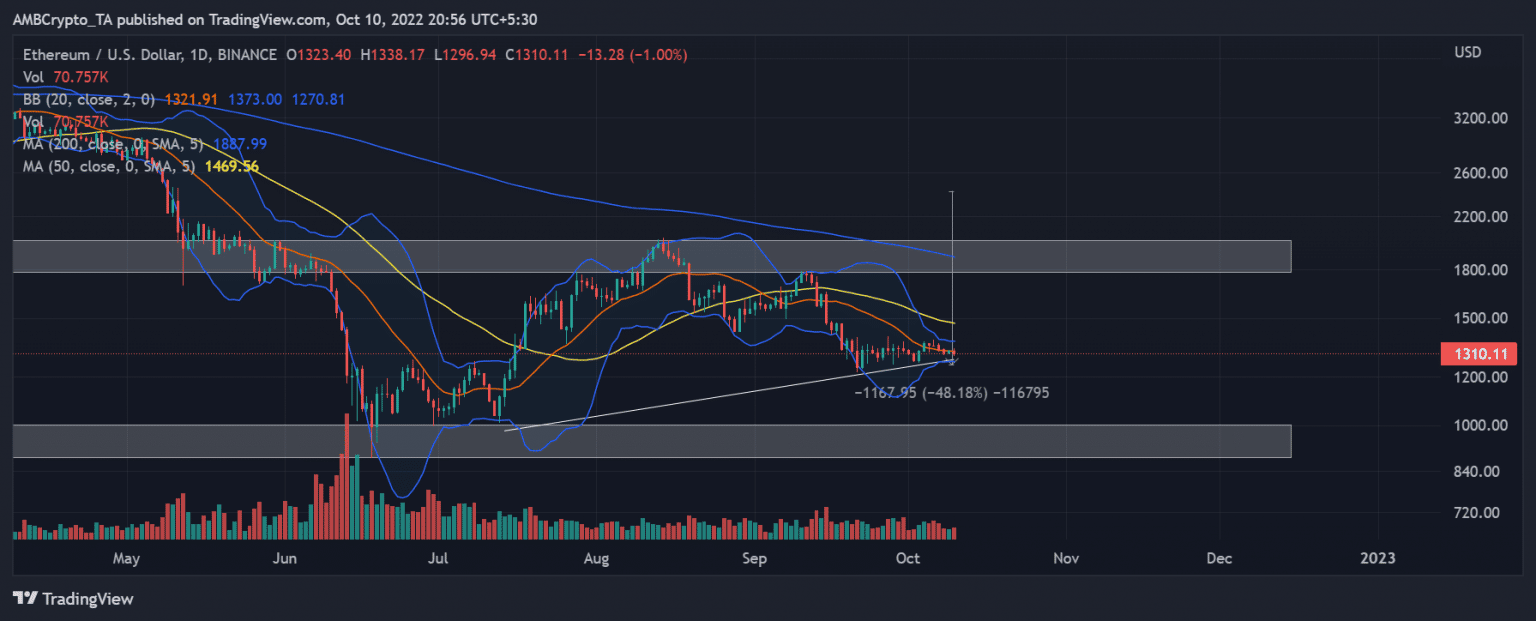

Trend lines analysis revealed that daily price activity was rising. It was clear that the cost of $2,013 and the previous record price of $1,780 prevented future price hikes.

The 200-point moving average provided resistance over the long run, and the 50-point moving average over the short term. The short MA was below the long MA, indicating a decline in ETH’s price.

Price Range reports that ETH fell 48.18 percent. It changed from being opposed to becoming supportive as the rising line got going.

If the price continues to decline, support could be between $1002 and $882. The price might hit $2,500 if it overcomes the initial resistance of the short MA.

ETH/USD Price chart. Source: TradingView

On Ethereum, several other projects that work with the network will be developed. This is because Ethereum is the largest smart contract network.

In the not-too-distant future, it is expected that the number of addresses connected to Ethereum will keep growing. Moreover, a record high in terms of the volume of transactions.

It’s feasible that this will affect pricing in a good way. Investors should pay special attention to the next potential move, however. Trading professionals should keep an eye out for future purchasing opportunities. Their observations should depend on how ETH moves over the following days and hours.